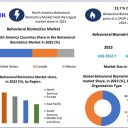

The Behavioral Biometrics Market size was valued at US 2552.7 Mn in 2023 and market revenue is growing at a CAGR of 23.7 % from 2024 to 2030, reaching nearly USD 11313.26 Mn by 2030.

Global Behavioral Biometrics Market: Trends, Dynamics, and Future Outlook (2024–2030)The Global Behavioral Biometrics Market, valued at USD 2552.7 million in 2023, is undergoing a transformative growth phase. With cybercrime becoming increasingly sophisticated and digital ecosystems expanding at an extraordinary pace, organizations worldwide are shifting toward advanced authentication models. Behavioral biometrics—powered by artificial intelligence, continuous monitoring, and contextual behavioral analysis—has emerged as one of the most reliable safeguards for digital identities. By 2030, the market is forecasted to reach USD 11,313.26 million, growing at a robust CAGR of 23.7%.

Understanding Behavioral Biometrics

Behavioral biometrics analyzes how a user behaves, instead of relying purely on physical identifiers like fingerprints or face scans. It observes and interprets unique behavioral signals, including:

Keystroke rhythm and typing cadence

Mouse trajectory and pressure points

Gait and posture detected by motion sensors

Voice modulation and speech patterns

Touchscreen gestures

Device orientation and movement patterns via accelerometers and gyroscopes

These cues are nearly impossible for attackers to replicate, making behavioral biometrics an increasingly preferred choice for continuous authentication, especially in high-risk industries like BFSI, healthcare, government, and e-commerce.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/25576/" target="_blank"> https://www.maximizemarketresearch.com/request-sample/25576/

Market Dynamics

Key Driver: Rising Security Threats Accelerate Adoption

As digital transactions surge and cybercrimes become more sophisticated, conventional security methods such as OTPs and passwords are no longer considered adequate. Financial institutions especially face massive pressure to secure online banking, digital wallets, and payment gateways.

Behavioral biometrics software—equipped with deep-learning models and real-time anomaly detection—forms a critical defense against:

Account takeovers

Identity theft

Bot-driven fraud

Credential stuffing

Social engineering exploits

The software segment leads the market due to its ability to seamlessly integrate into existing IT environments while delivering adaptive, frictionless authentication.

Key Restraint: Implementation Complexities

Despite its effectiveness, behavioral biometrics adoption faces challenges:

Integration difficulties with legacy systems

Need for specialized AI/ML expertise

Concerns around data privacy and regulatory compliance

High upfront and maintenance costs

User acceptance barriers due to misunderstanding of continuous monitoring

Overcoming these challenges requires strategic planning, partnerships with biometrics specialists, and a phased deployment approach.

Opportunity: AI and ML Transform Authentication

Advancements in machine learning, neural networks, and behavioral analytics are dramatically enhancing authentication accuracy. Systems now evaluate micro-behaviors that are undetectable to the human eye, making fraud detection more precise than ever.

Industries such as:

Banking

Healthcare

Retail & e-commerce

Energy & utilities

Government & public sector

are increasingly integrating behavioral biometrics for risk-based authentication, fraud prevention, and compliance-driven identity verification.

The rapid expansion of the Internet of Things (IoT) is another key growth catalyst. With billions of connected devices exchanging sensitive data, behavioral biometrics offers a non-intrusive, highly secure authentication layer across IoT ecosystems.

Market Segmentation Insights

By Component

Software (Dominant Segment)

Offers analytics, anomaly detection, continuous monitoring, and easy integration.

Services

Includes consulting, deployment, and managed support.

By Deployment

Cloud – Growing rapidly due to scalability and remote integration needs

On-Premises – Preferred by highly regulated industries

By Organization Size

Large Enterprises – Primary adopters

SMEs – Increasing adoption due to rising cyberattacks

By Application

Identity Proofing

Continuous Authentication

Risk and Compliance Management

Fraud Detection and Prevention

By End-User

BFSI (largest share)

IT & Telecom

Retail & E-Commerce

Healthcare

Government & Public Sector

Manufacturing

Energy & Utilities

Education

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/25576/" target="_blank"> https://www.maximizemarketresearch.com/request-sample/25576/

Regional Analysis

North America – Market Leader

North America dominated the global market in 2022. The region’s growth is fueled by:

High cybersecurity awareness

Presence of major tech players

Strict compliance regulations (GDPR-like frameworks, PIPEDA, state-level data protection laws)

Strong R&D ecosystem

Rapid digital transformation in financial institutions

Enterprises in the U.S. and Canada have been early adopters of AI-based behavioral authentication, reinforcing regional market leadership.

Europe

Propelled by stringent privacy regulations and growing adoption across BFSI and government sectors.

Asia Pacific

One of the fastest-growing regions due to:

Rapid digitization

Expansion of fintech and e-commerce

Increasing cyber fraud incidents

Innovations emerging from markets such as Japan, China, India, and Israel

Middle East, Africa, South America

Adoption is rising as banking, telecom, and government sectors accelerate digital transformation and security modernization.

Competitive Landscape

The market is characterized by rapid innovation, strategic acquisitions, and global expansion initiatives. Key developments include:

BioCatch

Expanded into the Asia-Pacific region

Recognized as a leading innovative company

Partnered with Microsoft to strengthen financial services security

LexisNexis Risk Solutions

Acquired BehavioSec to enhance digital identity and fraud prevention capabilities

ValidSoft

Introduced new voice-based authentication technology for secure enterprise remote access

Key Players by Region

North America

BioSig-ID (Texas, U.S.)

Plurilock (Canada)

UnifyID (California, U.S.)

TypingDNA (New York, U.S.)

OneSpan (Illinois, U.S.)

SecureAuth (California, U.S.)

IBM Corporation (New York, U.S.)

Mastercard (New York, U.S.)

SAS Institute Inc. (North Carolina, U.S.)

SecuGen Corporation (California, U.S.)

Aware, Inc. (Massachusetts, U.S.)

Europe

BehavioSec (Sweden)

AimBrain (United Kingdom)

XTN Cognitive Security (Italy)

Callsign (United Kingdom)

Asia Pacific

BioCatch (Israel)

SecuredTouch (Israel)

NEC Corporation (Japan)

Conclusion

The Behavioral Biometrics Market is at the forefront of a global shift toward AI-driven, continuous, and frictionless authentication. As digital systems become more interconnected and cyberthreats more complex, behavioral biometrics will play a decisive role in strengthening identity security across industries. With its ability to deliver real-time risk assessment and adaptive authentication, the technology is poised to redefine the future of cybersecurity and digital trust.

supriyamaximize

supriyamaximize

Lisa

Lisa jameswhaleer

jameswhaleer